Looking Back Memory Chip and Forward as 2024 Approaches

Since the pandemic threw the semiconductor supply chain off balance in 2020, OEMs and suppliers have kept a finger on the pulse of the market. The global chip shortage left many manufacturers, from consumer electronics to the car industry, scrambling to find the needed IC components. The imbalance between supply and demand across sectors remained unpredictable in the aftermath of the pandemic as a result of different geopolitical challenges and economic uncertainty/inflation. With a supply chain as complex as the chip industry’s, there are no quick solutions.

The past years have taught procurement specialists and engineers that they need to build resilience into their sourcing strategies to stay ahead. Several reports predicted the challenges in the semiconductor supply chain will lighten up by the end of 2023, and supply and demand will be stable again. Did that prediction hold up for the memory chip market? Can OEM procurement sit back and relax? Or how can they stay ahead of the game?

Upward trend

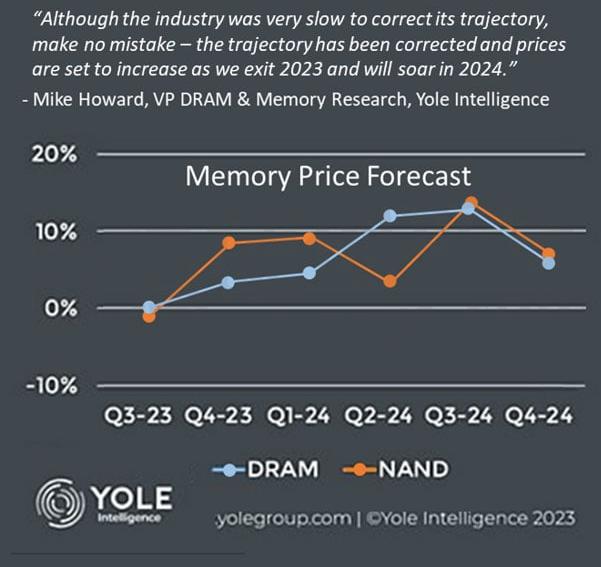

The memory chip imbalances resulted in customers stocking up, and then depleting their own inventory through 2022. In 2023, DRAM and NAND supply balanced and prices stabalized again as the oversupply that emerged after the pandemic got leveled out. An upward trend in prices for memory components is expected through 2024 driven by a demand increases and a supply shift to manufacturing next-generation components for mainstream markets, according to Yole Group. TechInsights and SEMI observed similar trends in their Semiconductor Manufacturing Monitor: The memory chip market is projected to log double-digit growth through 2024. All segments of the IC market are expected to increase year-over-year in 2024, including harder-to-source memory components for embedded applications.

Automotive and AI

Securing your semiconductor chip supply sooner rather than later can get you ahead of the curve. Product development and procurement teams globally, especially those in long-life applications, cannot sit idle and should revisit their memory chip sourcing strategy and supplier network. At the end of August, for example, Volkswagen announced that it is partnering with ten semiconductor manufacturers to get a better grip on their chip supply chain. The automotive industry, boosted by the surge in electric vehicles, is in fact one of the prime reasons for the projected DRAM market growth in the coming years beyond 2024. Additionally, the DRAM market is going through a transition. DDR5 has gone mainstream and manufacturers are converting DDR4 and legacy DDR3 capacity to service DDR5 demand. Memory chip suppliers are also already seeing that the surge in DDR5 demand for applications related to artificial intelligence and machine learning, which call for significant computing power and cloud storage, is making a dent in the supply chain outlook.

A resilient memory chip supply chain Big picture, the forecasts of the market conditions turned out valid. Experts in the field believe the rapidly increasing interest in new technologies will cause shortages in specific pockets of the market for DRAM and NAND. As the market is turning, OEMs need to continue to center their supply chain strategies around multi-sourcing, qualification of alternative components, and working with trusted suppliers to stay ahead. For procurement specialists and engineers who develop applications that rely on mature memory chip technologies, navigating market shifts is easier when working with a supplier who pretty much does that for them. Since our launch a year ago, SMARTsemi has focused on being a reliable and easy-to-use source of DRAM and NAND components for long-life applications. Don’t miss out - start 2024 in good shape with SMARTsemi.

- |

- +1 赞 0

- 收藏

- 评论 0

本文由咪猫转载自SMART (smartsemi News),原文标题为:Looking Back and Forward as 2024 Approaches,本站所有转载文章系出于传递更多信息之目的,且明确注明来源,不希望被转载的媒体或个人可与我们联系,我们将立即进行删除处理。

相关研发服务和供应服务

相关推荐

2024年Q3-DRAM与SSDA市场态势剖析:AI驱动下的涨势与变数

AI的蓬勃发展持续推动半导体和IT产业的成长,尤其在存储领域,生成式AI应用助长了市场对高性能运算方面的需求。从数据中心的AI服务器到消费端的AI PC,内存运算和存储性能表现至关重要,成为提升AI应用落地的关键推手。

2024年Q1 DRAM与SSD市场趋势及展望:存储产业强劲反弹

回顾2023年,受到整年持续的通货膨胀及地缘政治紧绷情势的影响,全球经济大幅放缓。值得注意的是,存储产业预估将一甩近年来的低迷,呈现正面态势并强劲反弹,这股复苏力度归功于AI相关技术的持续进展,有助于扩大工业和消费电子领域对密集型内存应用的需求。迈入2024年,请参考存储市场主要应用的价格更新和市场前景。本文中SMART与您分享2024年Q1 DRAM与SSD市场趋势及展望:存储产业强劲反弹。

The Road Ahead: DRAM Fueling Automotive Trends

The automotive industry is undergoing a massive transformation, driven by technological advancements and changing consumer expectations. Among the most significant trends shaping this evolution are advanced driver-assistance systems (ADAS), electrification, and rich infotainment systems. In our last blog post, we highlighted the role of FLASH memory in the automotive industry. Now, we dive deeper into how DRAM is chipping in to advance these industry trends.

Zetta存储器-EEPROM/NOR/NAND/DRAM

描述- 澜智集成电路(苏州)有限公司(Zetta)提供多种存储解决方案,包括SPI NOR Flash、SD-Nand和eMMC、I2C EEPROM以及DDR3L。其产品具备高性能、低功耗、高可靠性等特点,适用于工业、汽车、计算、消费电子、物联网、移动、网络和通信等多个领域。产品线涵盖不同电压、容量和封装类型,以满足不同应用需求。

型号- ZD24C512,ZD24C1M,ZDSD02G,ZDV4256M16A‐13DPH,ZDSD04G,ZD24C256,ZDV4256M16A‐11DPH,ZDSD64G,ZDSD32G,ZDSD256G,ZD24C64,ZD24C02,ZDEMDCM032G-84A8,ZDSD16G,ZD24C08,ZD25Q16C,ZDV4256M16A‐11IPH,ZDSD08G,ZDEMDCM016G-84A8,ZDV4256M16A‐13IPH,ZDV4128M16A‐13DPH,NB25Q40A,ZD25WQ80C,ZDV4128M16A‐13IPH,ZDV4128M16A‐11IPH,ZDV4128M16A‐11DPH,ZD24C128,ZDSD01G,ZD25WQ16C,ZD24C2M,ZDSD128G,ZD25Q128C,ZDV4256M16A‐14DPH,ZD24C32,ZD25WQ32C,ZD24C16,ZDV4256M16A‐14IPH,ZDEMDIW008G-84A8,ZD25Q80C,ZD25Q32C,ZD25Q64B,ZDV4128M16A‐14IPH,ZDEMMC04G,ZDEMDIW016G-95A8,ZDEMMC08G,ZD25WD20C,ZDEMDCM064G-95A8,ZDV4128M16A‐14DPH

用于超大规模网络的智能DRAM可靠、值得信赖、久经考验

描述- 本资料介绍了SMART Modular Technologies公司推出的SMART DRAM产品,专为超大规模网络基础设施设计。该产品采用高密度设计,具有低轮廓和超低轮廓高度,适用于网络和电信应用。SMART DuraMemory产品具有高可靠性,采用高质量组件和专家设计、测试和制造流程。产品支持周期长,与更长的设备生命周期(5-15年)相匹配。资料还提供了不同模块类型和密度的技术规格,以及产品在超大规模网络交换和路由设备中的应用。

SMART提供多款DRAM内存产品,可用于IIoT,较现成的工业级DRAM成本更低

SMART的DRAM内存产品能够满足数据的指数增长以及相关的数据处理需求。智能工厂、自动化机械、智能建筑、自动化农业设备和互联交通应用都在产生大量数据,必须收集、处理、存储和分析这些数据以满足不断变化的需求。其产品非常适合为IIoT应用提供长期可靠的支持。

适用于IIoT应用的智能DRAM存储器可靠、值得信赖、久经考验

描述- 本文介绍了适用于工业物联网(IIoT)应用的SMART DRAM内存解决方案。文章强调了IIoT应用对内存的需求,包括数据增长、本地化数据处理、高可靠性和长生命周期服务。SMART DuraMemory内存因其高可靠性、广泛的内存产品组合和针对环境威胁的多种解决方案而被推荐。文章还概述了SMART Modular Technologies提供的不同类型的DRAM模块,包括速度、密度和模块类型。

一键识别NAND闪存分类

NAND存储器约在四十年前被发明,如今已成为大宗商品,被广泛应用于消费性电子设备,例如智能手机、平板电脑和游戏机等。NAND闪存不需要电源也能保存数据,因此非常适合随身携带、设备内嵌或外接使用。本文中SMART将为大家介绍NAND闪存的不同分类,帮助大家更好地识别内存产品。

FORESEE 1.8 V SLC Parallel NAND Flash, in Line with Industrial-Grade Temperature Requirements, Accelerated Longsys’ Expansion into the 5G Market

Longsys‘ FORESEE industrial-grade storage product line launched the 1.8V SLC Parallel NAND Flash, to provide necessary data storage applications for electronic devices. The product meets the industrial-grade temperature requirements of -40℃ to 85℃.

适用于加固和工业应用的智能DRAM产品摘要概述

描述- 本资料主要介绍了适用于坚固和工业应用的SMART DRAM产品。内容包括SMART DRAM在宽温度范围、恶劣环境因素保护、抗冲击和振动条件下的可靠性、长期不间断服务以及多样化的外形设计等方面的优势。资料还详细介绍了SMART DRAM的技术、模块类型、速度和密度等规格,并提供了产品图片和联系方式。

Alliance Memory 512Mb (x8 and x16) DDR3 and DDR3L SDRAMs in the 78-ball and 96-ball FBGA Packages

Alliance Memory announced that it has expanded the industry’s widest offering of high-speed CMOS DDR3 and low-voltage DDR3L SDRAMs with new 512Mb, x8 and x16 devices in the 78-ball and 96-ball FBGA packages, respectively.

SMARTsemi DDR3 SDRAM产品获AEC-Q100 Class 2车规级可靠性认证

SMARTsemi是SMART Modular旗下的事业线,专注于长期稳定提供旧世代內存产品和工业级宽温零组件。SMARTSemi日前宣布DDR3 SDRAM正式加入Automotive Grade车规级应用行列,成为SMARTSemi扩展汽车级产品线的生力军。

适用于网络和电信应用的智能DRAM存储器可靠、值得信赖、久经考验

描述- SMART Modular Technologies提供适用于网络和电信应用的SMART DRAM内存模块,具有高可靠性、抗硫化和环境保护特性。产品包括多种模块类型、速度和密度,适用于路由器、网关、以太网交换机、VPN和防火墙服务器等。SMART Modular Technologies提供长期供应和技术支持。

SMART’s DuraFlash ME2 SATA M.2 2280 SSDs Offer 80mm Length with 3D NAND Technology

SMART’s DuraFlash ME2 SATA M.2 2280 SSDs offer 80mm length with 3D NAND technology, and support both commercial and industrial temperature range.

适用于高性能计算(HPC)应用的智能DRAM内存可靠、值得信赖、久经考验

描述- SMART Modular Technologies提供针对高性能计算(HPC)应用的SMART Zefr Memory,专为应对高强度计算工作负载而设计。Zefr Memory通过筛选过程,确保在苛刻的工作负载下提供超高可靠性。该产品支持Chipkill技术,可保护计算机内存系统免受单个内存芯片故障或多位错误的影响。SMART提供全面的售前和售后技术支持,适用于药物开发、石油勘探、汽车、航空航天设计和建模以及银行和金融服务等领域。产品包括多种模块类型、速度和密度,详细信息可在SMART Modular Technologies官网查询。

电子商城

现货市场

服务

可烧录MCU/MPU,EPROM,EEPROM,FLASH,Nand Flash, PLD/CPLD,SD Card,TF Card, CF Card,eMMC Card,eMMC,MoviNand, OneNand等各类型IC,IC封装:DIP/SDIP/SOP/MSOP/QSOP/SSOP/TSOP/TSSOP/PLCC/QFP/QFN/MLP/MLF/BGA/CSP/SOT/DFN.

最小起订量: 1 提交需求>

可加工PCB的尺寸范围:50*50mm~610*508mm,板厚:0.3mm~4.5mm,元件尺寸:最大200*125mm,最小引脚零件间距:0.3mm,最小BGA间距:0.3mm,支持01005 chip件贴装。

最小起订量: 3 提交需求>

登录 | 立即注册

提交评论